Podcast Show Notes [Read Full Article]:

Episode: The Next Apple? Why 2026 Illumina is Mirroring 2012 AAPL.

“In the architecture of life, a strategic error is a mutation, not a permanent defect. While the market panics over past complications, the financial DNA reveals a surgical recovery and a return to infrastructure dominance.”

In this 15:52 diagnostic briefing, we move past the headlines to examine the “Biological Infrastructure” of Illumina Inc. (ILMN). We apply a rigorous EMBA-level framework to 8 years of 10-K data, treating the balance sheet like a clinical report to determine if Illumina is poised for a 2012 Apple-style valuation rebirth.

The Diagnostic Report:

The Genomic Toll Bridge: Why Illumina remains the non-negotiable standard for the biological age. We discuss the “Operating System” analogy—why the world’s most advanced sequencing railroad is still the only way to reach the destination of precision medicine.

Surgery on the Grail Complication: A forensic look at the 2024 spin-off as a “strategic cauterization.” We examine how “Value through Subtraction” has stabilized the patient’s vitals and removed the primary source of cash-flow inflammation.

FCF Vital Signs: Stripping away the $3.9B impairment “bruising” to find the 80% recurring revenue heartbeat. We analyze why the Razor-and-Blade model is more resilient than the market currently believes.

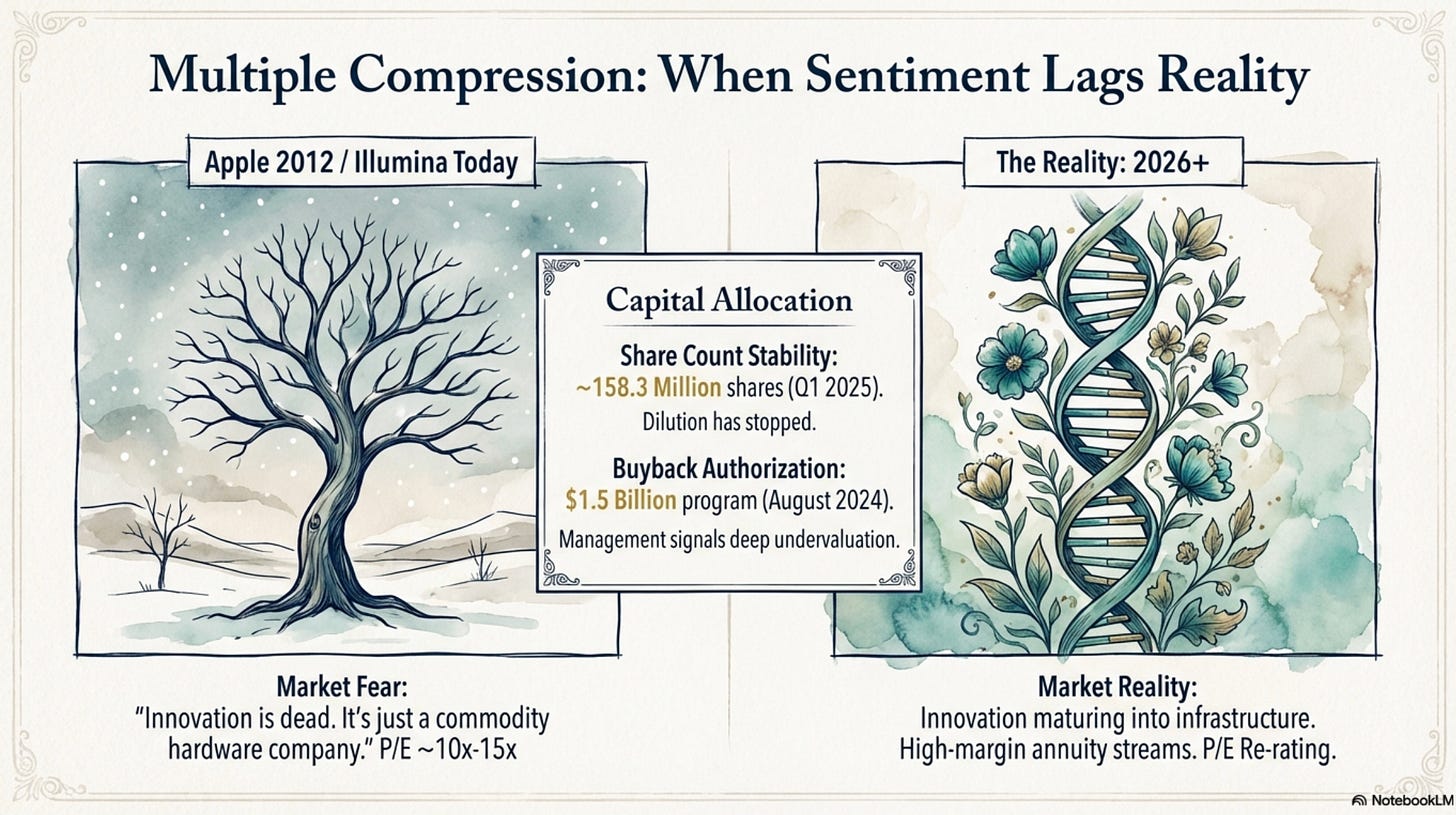

Multiple Compression Syndrome: Analyzing the disconnect between price and intrinsic value through the lens of Apple’s 2012 turnaround. We explore why sentiment-driven misdiagnosis creates a unique entry point for quality-first investors.

Key Timecodes:

[00:00] The Patient History: From the Solexa “Golden Spike” to 90% global market dominance.

[04:15] Diagnostic Imaging: Deep dive into the Razor-and-Blade margins—why consumables are the ultimate hedge.

[07:45] Trauma Assessment: Evaluating the $8B Grail inflammation and the regulatory “immune response.”

[11:20] Recovery Protocol: Jacob Thaysen’s “Operational Excellence” and the $100M cost-reduction treatment.

[13:50] The Prognosis: Calculating the 33.6% CAGR based on a reversion to 35x P/E.

The “Doctor X” Take:

“As an investor with a medical background, I look for ‘Systemic Resilience.’ In the genomics world, Illumina isn’t just a vendor; it’s the Infrastructure for the entire industry. You don’t abandon a primary platform because of a temporary strategic detour—you stay for the outcomes and the accountability of the moat. The diagnosis: The fever has broken, and the recovery is structural. Quality first. Everything else is noise.”